On-Demand Service Economy in the U.S.: How to Launch Your Own App

In this article, you will find out how the on-demand model works, what the market looks like for on-demand businesses in the U.S., and how new players can enter and compete.

What’s the on-demand service economy, and why is it booming?

The simplest definition of on demand services is getting a product or service exactly when and where you need it. It’s a shift away from scheduling and fixed supply toward real-time matching of consumers and providers.

How it works

That’s how the on demand model actually plays out behind the scenes:

- Customer places a request through an on-demand app or website, the user selects the service they need.

- System checks availability, verifying the pricing, provider availability, and location.

- Request is matched to a provider, as a nearby driver or service professional is assigned automatically.

- The system processes payments, updates the user on progress, and sends alerts to both sides.

- Customers see immediate results, while the business enjoys a repeatable, organized workflow.

With this level of control and convenience, it's no wonder that on-demand services are exploding in popularity. The COVID-19 pandemic accelerated adoption of on-demand services worldwide, with lockdowns and social distancing having a massive impact on consumer behavior.

Expectations have shifted so much that if something isn’t available on demand, and delivered fast, it feels broken. This mindset is especially prevalent among younger consumers, ramping up adoption across more industries and service categories.

For businesses, there are several clear benefits to adopting the on-demand model. When implemented correctly, it allows companies to:

- Scale supply up or down based on real demand

- Reduce employee idle time

- Operate with clearer, more predictable margins

What kinds of on-demand services are out there?

To answer this question, most people would first think of the obvious categories like delivery apps, ride-sharing, and food or grocery platforms. Giants like DoorDash, Uber, Lyft, Instacart, and Airbnb shaped how people think about on demand online services, and are often cited among the best because they proved the model works at scale. Today, there’s a massive list of online services in the U.S. that try to copy their success.

New business opportunities

But the real opportunity isn’t always where the biggest players are. In the U.S., this is especially true in highly regulated markets like ride-sharing. Large TNCs (transnational corporations like Uber) dominate through scale and lobbying power. That makes direct competition tough, but it also creates gaps they don’t serve well.

Many on-demand startups are gaining traction in niches that are region-dependent and program-driven. Services like non-emergency medical transportation (NEMT), airport transfers, corporate and event transportation are growing quickly.

- NEMT: growing 5–8% per year, driven by an aging population, Medicaid outsourcing, and chronic care needs

- Airport transfers: growing 3–5% per year, supported by air-travel recovery, tourism, and restrictions on large ride-hailing platforms

- Corporate / contract transportation: growing 2–4% per year, as companies outsource employee transport and require managed billing and duty-of-care

In these segments, customers care far more about reliability and compliance than the lowest possible price. For example, in NEMT, the priority isn’t saving a few dollars per ride, it’s ensuring patients get safely from point A to point B, on time and in line with medical and regulatory requirements.

Single-service apps vs “everything-in-one” apps

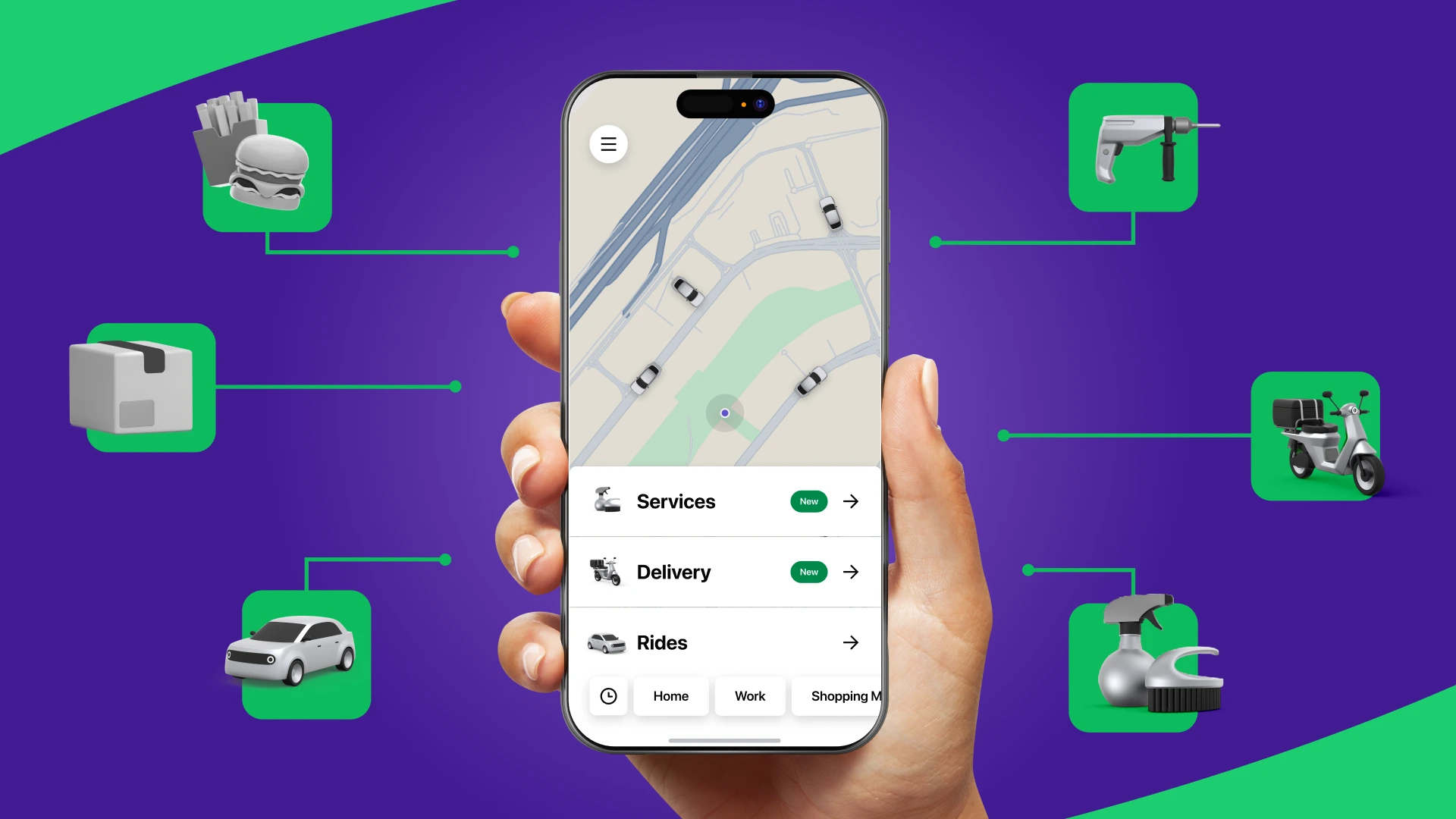

Some on-demand businesses do best with a single-service focus — one use case, one workflow. But there's also much to be gained from a broader platform approach, when multiple services are bundled (think Uber with its subdivisions for food delivery, packages, corporate travel, etc.)

Everything-in-one apps can improve their SLAs and margins, especially when services manage to share the same infrastructure. But smaller businesses need not be discouraged: specialization still wins in regulated or contract-heavy segments.

Services on demand are a flexible framework. It's more important to pick the right niche and app structure than to copy the biggest name in the app store.

What does a successful on-demand app actually need?

If you’re thinking about bringing your mobility or service business online in the U.S., it’s easy to feel overwhelmed. The market looks crowded, and building an app sounds expensive and complex.

The reality is that regional and niche operators don’t need a massive, all-encompassing product. A focused, reliable digital setup that supports their specific services and has room for future growth is more than enough to make a good start. Here's what to look for:

Core features

- easy booking with clear service options

- real-time tracking and status updates

- secure payments built into the app

- ratings and reviews for customer and provider accountability

Stable infrastructure

- reliable backend that doesn't crash when the demand is high

- regular feature updates and security patches

- scalability for customer and driver growth

Simple, role-specific interfaces

- attractive and intuitive app for customers

- fast and task-focused app for providers

- clear and practical dashboards for admins and dispatchers

Built-in ways to grow revenue

- flexible pricing and service configurations

- tools for attracting and retaining users online

- clear analytics to understand what works and where to improve

Lessons from Mobilize 2025

Mobility businesses should position themselves carefully

In the U.S. mobility market, how you describe your service matters. Companies that position themselves as direct ride-share or TNC alternatives often face high insurance premiums that are 3-4 times higher.

NEMT is a great alternative to saturated ride-share

Non-Emergency Medical Transportation (NEMT) continues to attract strong demand. The segment is driven by government programs like Medicare and Medicaid and relies on brokers rather than open marketplaces. On the one hand, the compliance and billing requirements are high; on the other, competition is more fragmented.

Build for the consumer of tomorrow

It's true that a sizable portion of the U.S. taxi market still lives in a “dispatch world,” with phone bookings and call centers. Still, the long-term shift is clearly toward digital, with rising expectations for transparency and ease of use.

How to launch on-demand services in the U.S. without overspending

Many emerging on-demand services in the U.S. run into trouble by moving too fast or building too much. Onde's experience shows that with businesses going digital for the first time, the priority shouldn’t be perfection. Look for a practical setup that can withstand the realities of the market and leaves enough room to adjust.

Choose the right build approach: custom vs ready-made

Building a custom app from scratch can sound appealing, but it’s often expensive, slow, and risky. For most fleets and service providers, white-label platforms offer a more cost-effective path with proven workflows, compliance-ready features, and a shorter time to launch.

Validate the idea before committing serious budget

Focus on a single service, a defined region, and clear operational rules. The MVP approach of "launch, learn, refine" helps you spot real issues like cancellations, idle vehicles, or pricing mismatches before they become expensive problems.

Use AI only where it adds value

AI can improve operations when applied thoughtfully. Good examples are optimized routing and dispatch to reduce delays, demand forecasting to improve capacity planning, or multilingual support for ethnically diverse markets. Avoid adding AI features with unclear benefits just for hype.

Design driver-friendly economics

Where ride-sharing and delivery are concerned, driver retention is critical. Here, pricing structures play a big role. New business models favor low- or no-commission approaches (with platforms taking just 0–10% instead of TNC's 25–35%), often supported by driver or rider subscriptions. A reputation for fairness helps attract providers and improve the reliability of your services.

Follow predictable demand

When planning your U.S. launch, think beyond the standard TNC business model. Niche or vertical-focused services, like women-only rides or family/child transport, create predictable demand and differentiate you from mass-market apps. Subscription-based models work well for commutes, university towns, or corporate mobility, giving you steady revenue and repeat usage. And finally, fixed-price or no-surge services appeal to airport transfers and events.