Lesson 1.

Driver balance and billing logic

Drivers fees collection is one of the features Onde clients love the most. No wonder, after all, this automation is equally handy for both mobility startups and traditional taxi companies eager to streamline their operations. You already know that fees calculation and collection is fully automated in the Onde system. Once you’ve set up a driver work plan, the billing system will do all the boring stuff.

Manage driver working plans and fees in My hub

In My hub, all the driver management operations happen in the Company management tab. Have a look at the screenshot below.

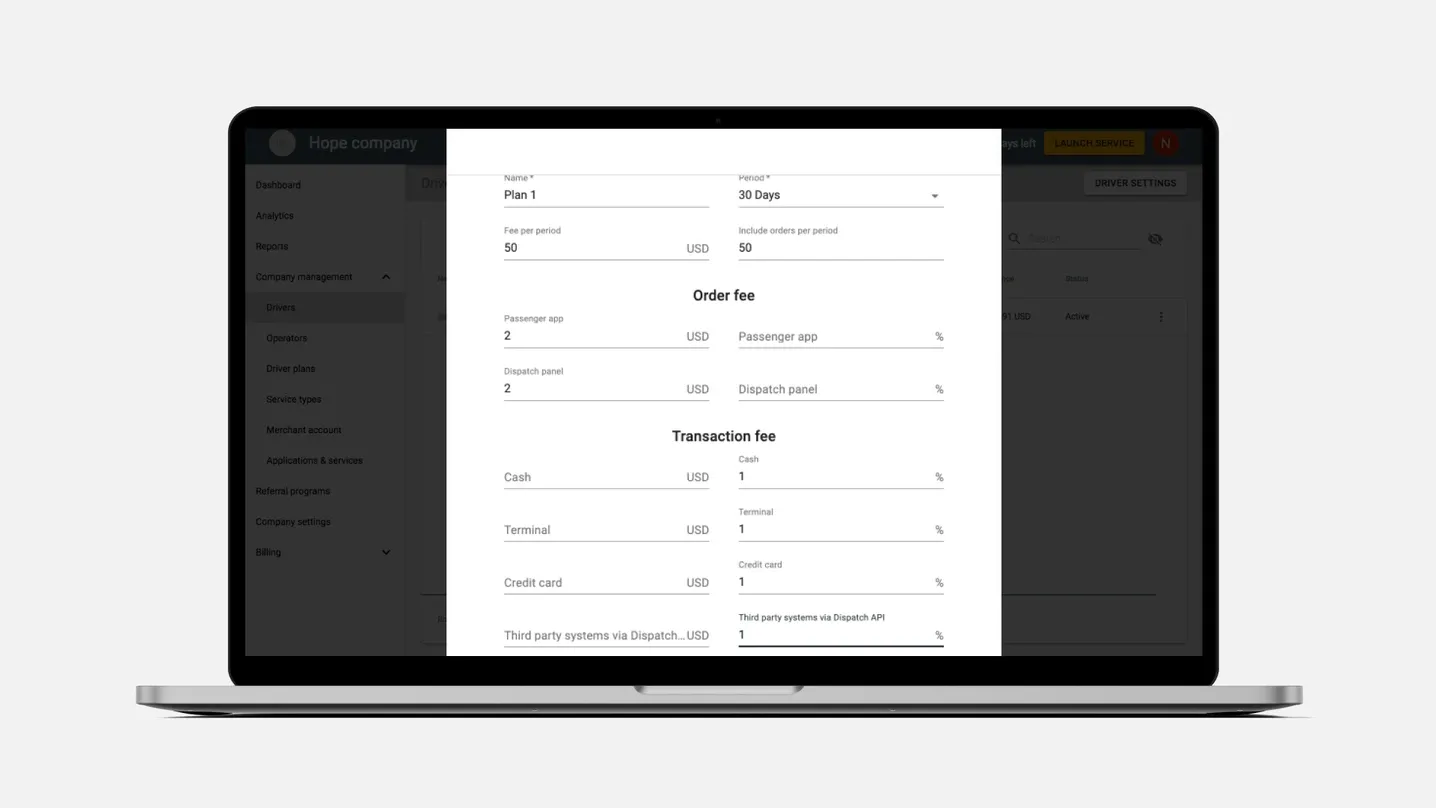

In the Driver plans tab, you can set rules for driver working plans:

- driver fees per period of working

- maximal number of orders per period of working

- order fees (you can specify different fees for orders coming via the app and the Operator app)

- transaction fees.

Check this out:

You can create as many driver plans as it is handy for you. Driver plans are there to automate driver fees — once all the rules are set, the system calculates commissions automatically.

You can subscribe drivers to various driver plans. This ultimately makes managing driver fees easier and quicker. Let’s see how a driver plan as pictured above would work.

Say, you create a plan where a driver pays a fee of 50$ every month, which allows them to take 50 orders. Any order after the first 50 will be charged as followed:

- 2$ for orders from Passenger app

- 2$ for orders from Dispatch

With this very plan, your company would also charge drivers with a 1% transaction fee no matter what payment method a passenger would choose. In this case, transaction fees will as well apply to the “free” orders (the first 50 orders included in the $50 monthly charge) as well.

All the plan parameters are optional — leave any of them out. Twist the fees to maximize the profit from every ride and see what working plans are the most attractive for the drivers.

After a new working plan is created, you can subscribe your drivers to it. Being subscribed to a plan is necessary for drivers to get an active credit tab. Otherwise, they won’t be able to make in-app payments or upload payout details.

Using driver plans, you can subscribe drivers to a monthly, weekly, daily, or per-order plan and thus fees. If a driver is on a per-order based subscription, their balance is charged every time they take a job. Monthly, weekly, and daily chargers are extracted from driver balance every set period.

You can combine per-period and per-order fees in one subscription, too! Subscriptions are constantly repeated until you subscribe a driver to a different plan.

Every driver gets an account in the system. They can view their balance in the app, too.

Understand automated driver billing logic

There are several crucial things about how driver billing happens in the Onde system. Let’s get through them all.

Balance top-ups

To be able to take orders, drivers need to top up their balance regularly.

When a driver’s balance becomes lower than allowed in Driver settings, they receive the following notification:

“You will not be able to accept jobs since your credit is negative. Please add credit to continue work. You can contact the company administrator should you have any questions”.

Drivers get an email notification of the negative balance.

We will talk about the possibility of taking orders with a negative balance in the next chapter of this course.

There are two ways for drivers to top up their balances:

- Via the driver app. In this case, they’re making a credit card payment on your merchant account. Please note that drivers only see the “Credit” option in the side menu if they have an active subscription to a working plan.

- By cash. Drivers can bring money to your company’s office, where an administrator could top up their balance manually via My hub.

Most companies try to avoid cash use, as card payments are safer for both drivers and company management. However, you decide.

Commissions from orders paid with cash

When a passenger pays their trip with cash, the money goes to the driver’s pocket.

Accordingly, in this case, the automated billing system registers the payment but does not top up driver balance with the total received.

The system calculates the order fee and charges it from the driver’s balance instead.

If your company receives cash and terminal payments only, and you don’t allow drivers with a negative balance to work, make sure the drivers top up their balances enough before starting the shift. Otherwise, the driver won’t be able to accept and process any jobs.

Credit card payments flow

If a passenger pays their trip by credit or debit card, the system registers the payment and fills a driver's balance with the price of the trip.

After that, the system calculates the order commission and charges it from the balance.

Drivers can use the received credit card payments to cover commission for cash and terminal payments or the fees per period.

You can configure automated driver payouts in the My hub. When you do so, the balances will be debited, and funds transferred to payout reports with driver bank details. Managers at your company will then need to make transfers to drivers’ bank accounts.

The key idea here is that your drivers always keep the cash (if the company works with it), while your company gets cashless commissions via the driver’s balance.

The system makes all the complicated calculations.